capital gains tax budget news

As per Budget 2018 long-term capital gains on the sale of equity shares units of equity oriented fund realised after 31st March 2018 will remain exempt up to Rs. I purchased a piece of vacant land in urban area in 2005 through registered sale deed.

State Taxes On Capital Gains Center On Budget And Policy Priorities

However if the asset is owned by a company the company is not entitled to any CGT discount and youll pay a 30 tax on any net capital gains.

. And for an SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. If Land or house property is held for 36 months or less 24 months or less wef. According to the IRS property owners will pay a 15 tax unless they exceed the higher income level.

You could owe 22429 in taxes on this sale. FY 2017-18 then that Asset is treated as Short Term Capital Asset. Moreover tax at 10 will be levied.

When you sell a capital asset the difference between the purchase price of the asset and the amount you sell it for is a capital gain or a capital loss. According to the Indian Income Tax Act 1961 the resident individual is liable to pay long-term capital gains at the rate of 10 on amounts exceeding Rs1 lakh. One is short term.

The amount of exemption under Section 54 of the Income Tax Act for the long-term capital gains will be the lower of. In 2022-23 you can make tax-free capital gains of up to 12300 the same as in 2021-22. Dear Sir Thanks for your valuable article on how to save capital gain tax on sale of land.

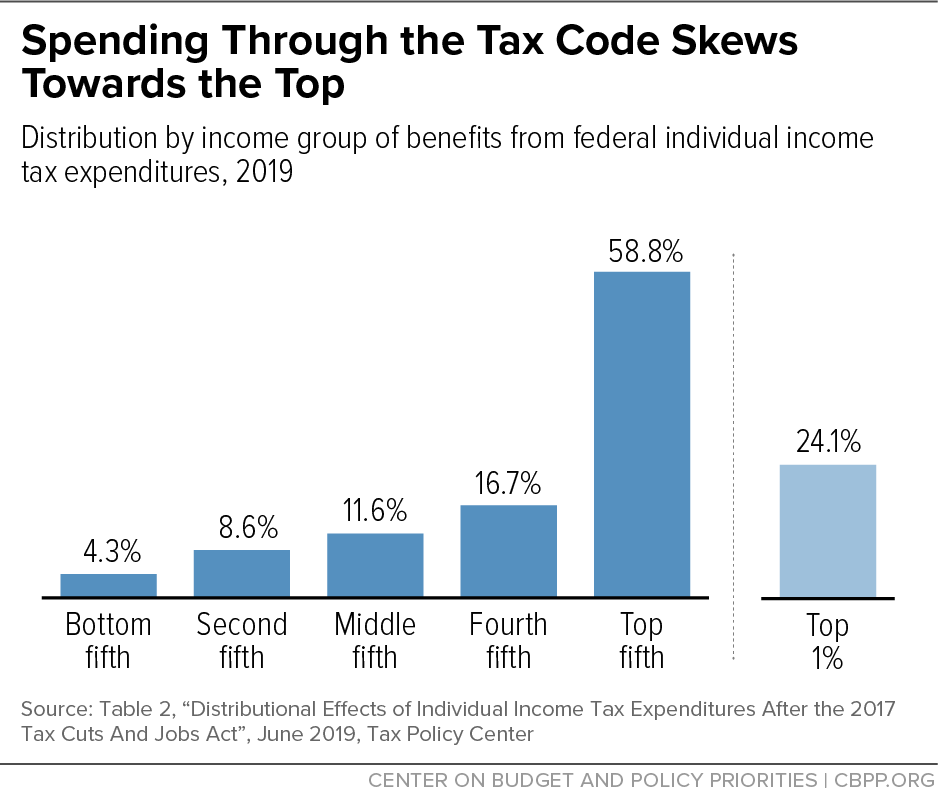

As a married couple filing jointly they were able to exclude 500000 of the capital gains leaving 200000 subject to capital gains tax. The Capital Gains have been divided in two parts under Income Tax Act 1961. At the state level income taxes on capital gains vary from 0 percent to 133 percent.

It forms part of normal income tax and is based on the sliding tax tables for individuals. Short-term capital gains are taxed at your ordinary income tax rate. Hence the balance capital gains If any will be taxable.

1 lakh per annum. You must first determine if you meet the holding period. Capital gains and losses are classified as long-term or short-term.

Long-term capital gains tax. Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Whats the 2021 and 2022 capital gains tax rate.

See HMRCs Capital Gains Manual CG71870 for more information. Any Income derived from a Capital asset movable or immovable is taxable under the head Capital Gains under Income Tax Act 1961. This is a lot even when you remember that you made.

There are two main categories for capital gains. Their combined income places them in the 20 tax bracket. This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent.

A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory asset. The 1990 and 1993 budget acts increased ordinary tax rates but re-established a lower rate of 28 for long-term gains though effective tax rates sometimes exceeded 28 because of. CGT event is the date you sell or dispose of an asset.

Couples who jointly own assets can combine this allowance potentially allowing a gain of 24600 without paying any tax. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022. 0 Percent 0-40400 Single0-80800 Married.

0 15 and 20. The most common capital gains are realized from the sale of stocks bonds precious metals real estate and property. If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income.

Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total. Suppose the gains become taxable in Indias home country the USA. 18 thoughts on 5 Ways To Save Capital Gains Tax On Sale of Property SPatel August 7 2017.

If you have more than 3000 in capital losses this excess amount can be carried forward to future years to similarly offset capital gains or other income in those years. This is because they are entitled to an annual tax-free allowance called the annual exempt amount AEA. The amount of capital gains that is not appropriated by an assessee towards the purchase of another property before one year from the date of transfer or within two year from the date of transfer of the original property or constructed within 3 years.

In 2021 for singlemarried filers the capital gains tax rates have been set at. Capital gains arise when the consideration received on transfer or sale of a property is more than its indexed cost. It comes about most often for taxpayers when their home or investment property is sold for a profit gain ie.

This is a simplified version of finding your capital gains tax burden but the basics are there. The investment made in purchase or construction of a new residential house property. From this date Capital Gains are calculated at either an 18 or 28 tax rate dependent upon the amount of your other taxable income during the tax year.

The formula is the same for capital losses and. Since the 2013 budget interest can no longer be claimed as a capital gain. Having observed variations in capital gains tax computation the revenue department is working on a mechanism to analyse futures and options FO trade data and pre-initial public offering IPO transactions.

The proceedsselling price is more than the base cost. Long-term capital gains are taxed at only three rates. This is true even if theres no net capital gain subject to tax.

In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. Long-term capital gains that is gains on assets held for a at least a year are generally taxed at a much lower rate than earned income money that you get from working. What is the annual exempt amount.

What is a Capital Gains Tax event. Capital Gains Tax was introduced on 1 October 2001. What is Capital Gains Tax.

This measure maintains the Capital Gains Tax annual exempt amount at its current amount of 12300 for individuals and personal representatives and 6150 for most trustees of settlements for. Each tax year most individuals who are resident in the UK are allowed to make a certain amount of capital gains before they have to pay CGT. Any profit or gain that arises from the sale of a capital asset is a capital gain.

Capital Gains Tax. The base cost is the purchase. If youve owned your second home for more than a year youll typically pay a long-term capital gains tax between 0 and 20 depending on your earnings.

Long Term Capital gains arising on transfer of residential house Or. For Capital Gains made during the 20102011 Tax Year the calculation is quite complicated as the Government changed the tax scheme from 23rd June 2010. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital Assets. 50000 - 20000 30000 long-term capital gains.

Biden S Better Plan To Tax The Rich Wsj

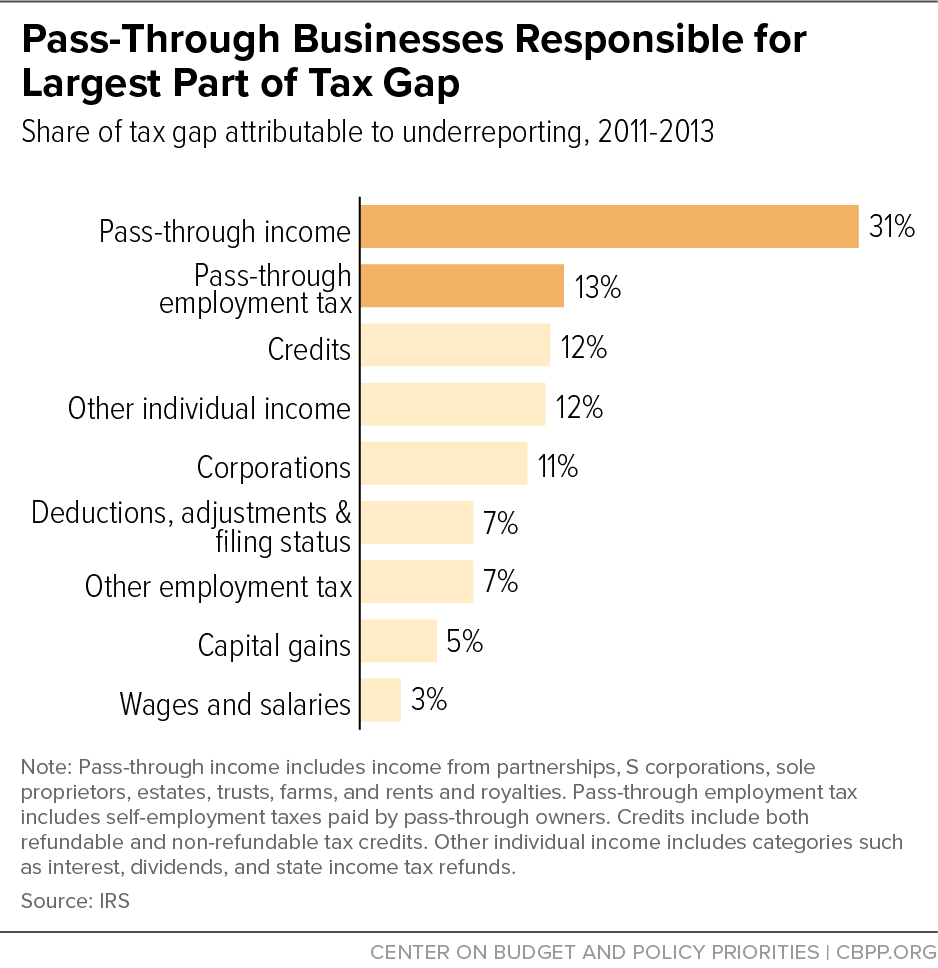

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

Senate Revenue Package Is Sound Policy Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities

Biden Budget Biden Tax Increases Details Analysis

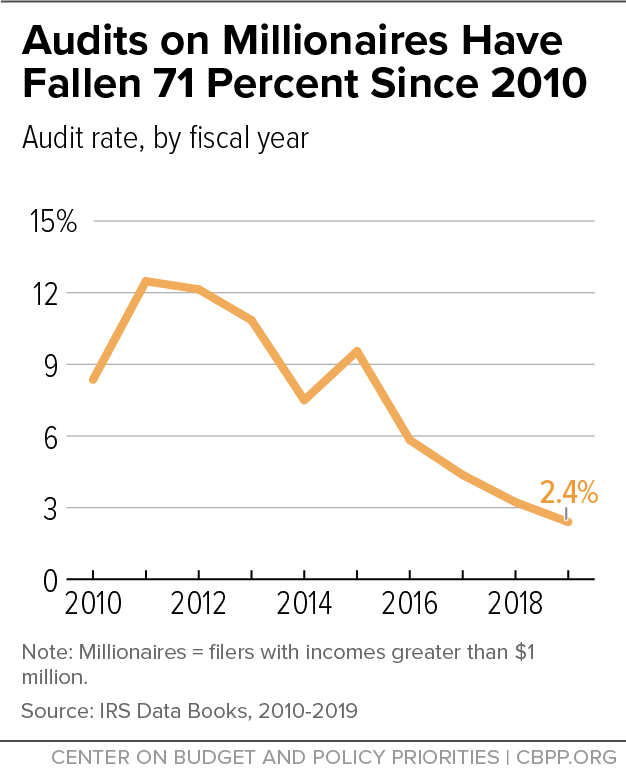

Chart Book The Need To Rebuild The Depleted Irs Center On Budget And Policy Priorities

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

How To Save Capital Gain Tax On Sale Of Residential Property

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

The Long And Short Of Capitals Gains Tax

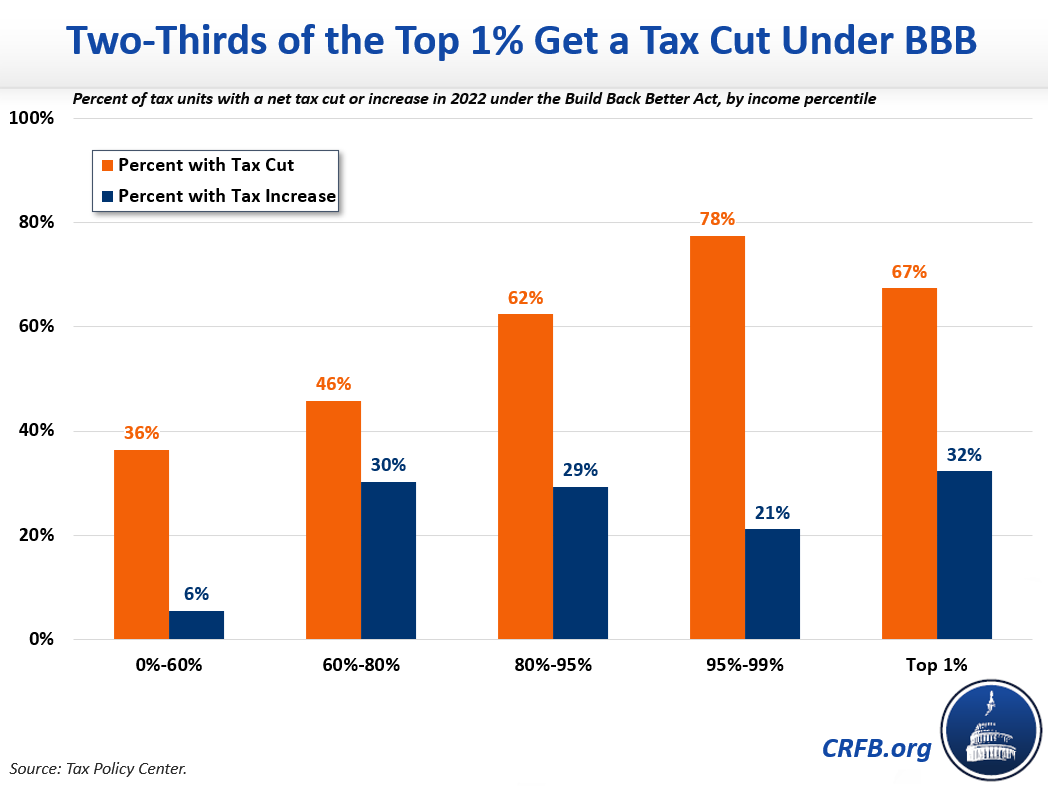

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Income Tax Change Ltcg Surcharge Capped At 15 What It Means For Taxpayers Mint